Istryingtokeeptrackofyourfinancesboggingyoudown?Hereareafewbasicrulestokeepyoudebt-free.Nareshhaditall.Agoodjob,hisownhouse,andevenafancynewcar.Heandhisfamilylivedanamazinglife.Theywenttopartiesandhadmealsatfancyrestaurantsonaweeklybasis.Heboughtallthelatestgadgets,nomatterhowexpensive.Untiloneday,whenthebankcalledhimupandsaidheowedthemalargeamountofmoney.Nareshwasshocked.Uponchecking,herealisedthebankhadnotmadeamistake.Hehadtosellmanyofhispossessionsandmovetoasmallerhousesohecouldpaybackthemoneyheowedthebank.Yet,hecouldnotunderstandhowhereachedthisstateinthefirstplace.Manyofusarenotverygoodatkeepingtrackofourmoney.Termslikebalancingchequebooksandinterestaccumulationseemalientous.However,learningtomanageourfinanceswiselyisveryimportantandcangoalongwaytowardsgivinguspeaceofmind.InthisarticleSayNotoCardsKeepMoneyAvailableGetYourselfSomeInsurancePlanfortheFutureSayNotoCardsCreditcardsareasafeandconvenientalternativetocarryinglargeamountsofcashinpublicplaces.However,whileusingacreditcard,itisveryeasytolosetrackofhowmuchmoneyyouarespending.Creditcardcompaniesarealwayslookingforcustomerstoselltheircardsto.Youmayevenbecontactedonadailybasisbydifferentcompanies,whowilloffertheircreditcardsservicestoyou.Itisuptoyoutoactresponsiblyandnotacceptmorecardsthanyouneed.Companieswilltrytoenticeyoubyofferingattractiveschemeslikelowinterestratesandtellingyouhowyouwillbeabletobuyallyoueverwanted.Donotbeswayedbytheirclaims.Themainpointtorememberisthatcompanieswillapproveyouforacreditcardevenifyoudonothaveajob.Whilethismayseemlikeagoodthing,thebottomlineisyouneedtoattendtoyourmonthlycreditcardbills.Ifyouonlypaytheminimumamountspecifiedbythecompanyeverymonth,youwillstillbechargedinterestonthebalanceamountpending.Thismeansthatyouwillbegintoaccumulateinteresteverymonthonyourbalanceamountunlessyoupaytheentiresum.Anotherthingthatcompaniesneglecttomentionissomethingcalledasrevolvinginterest.Youknowthatyouarepayinginterestonyourbalanceamountdue.However,whatyoudonotrealiseisthatyouarealsochargedinterestontheinterestamountitself.Thismeansthattheinterestamountitselfkeepsaccumulatingandcouldwindupbeinghigherthantheoriginalamountthatyoudidnotpay.Thebestwaytoavoidbeingtrappedinsuchasituationistonotacceptcreditcards.Ifyoureallyneedthemandtheresnootherwayout,limityourselfatthemosttotwoorthreecreditcards.Trytopayoffyourbillseverymonthsothatyouarenotchargedinterestonanybalanceamountsdue.KeepMoneyAvailableItisalwaysagoodideatohaveareasonableamountofmoneyinyoursavingsaccount.Thisway,youcancoveremergencyexpenseslikesicknessorinjuriesthatrequirehospitalisationorextensivetreatment.Youwillalsohaveenoughmoneyavailableforgroceries,bills,fees,etc.ifyouloseyourjobandcannotfindanotheroneimmediately.Setasideapredeterminedamountofmoneyeverymonththatwillconstituteyoursavings.Youmayhavetoforgodinnersinfancyrestaurantsbutitwillbeworthit.Anythingbeatsdebts!GetYourselfSomeInsuranceAnothercommonmistakethatpeoplemakeisnottohavelifeandhealthinsurance.Whilemostcompanieswillofferyouinsuranceforthedurationthatyouareanemployee,youshouldrememberthatthisisnotpermanent.Ifyouleave,orifyouarelaidoffatyourworkplace,youwillloseyourinsurance.Thiswillleaveyoufinanciallyvulnerableifsomeillnessormishapbefallsyouoramemberofyourfamily.Trytoimaginewhatitwouldbelikeifyourfamilydependedonyourincomefortheirdailylivingandyouleftthemwithoutanymoneyforthemtobeabletosupportthemselves.PlanfortheFutureItisnevertooearlyforyoutostartplanningforyourretirement.Bywaitingtillyouareolder,youarelosingachancetoincreaseyourmoneythroughinvestments.Also,beginsavingmoneyforeducationalexpenses,assoonasyourchildisborn.Thisway,youwillbeabletoinvestsmalleramountscomparedtothemoneyyouwillhavetoinvestifyouwaitforyourchildtoreacharoundtenyearsofageandthenbegin.Keepingyourfinancesinorderisnotsuchadifficulttask.Allyouneedisalittletime,andafewsimpledecisions,tobeabletosaygoodbyetoyourfinancialtroubles.

Is trying to keep track of your finances bogging you down? Here are a few basic rules to keep you debt-free. Naresh had it all. A good job, his own house, and even a fancy new car. He and his family lived an amazing life. They went to parties and had meals at fancy restaurants on a weekly basis. He bought all the latest gadgets, no matter how expensive. Until one day, when the

bank called him up and said he owed them a large amount of money.

Naresh was shocked. Upon checking, he realised the bank had not made a mistake. He had to sell many of his possessions and move to a smaller house so he could pay back the money he owed the bank. Yet, he could not understand how he reached this state in the first place.

Many of us are not very good at keeping track of our

money. Terms like 'balancing chequebooks' and 'interest accumulation' seem alien to us. However, learning to manage our finances wisely is very important and can go a long way towards giving us peace of mind.

Say 'No' to Cards

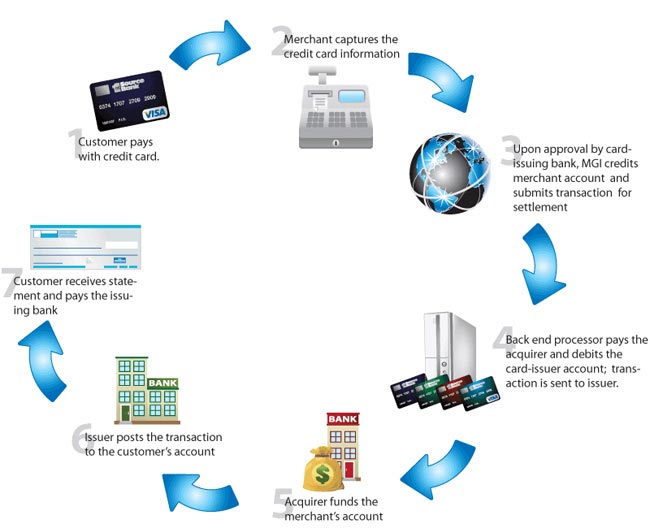

Credit cards are a safe and convenient alternative to carrying large amounts of cash in public places. However, while using a credit card, it is very easy to lose track of how much money you are spending. Credit card companies are always looking for customers to 'sell' their cards to. You may even be contacted on a daily basis by different companies, who will offer their credit cards services to you. It is up to you to act responsibly and not accept more cards than you need.

Companies will try to entice you by offering attractive schemes like 'low interest rates' and telling you how you will be able to buy all you ever wanted. Do not be swayed by their claims. The main point to remember is that companies will approve you for a credit card even if you do not have a job. While this may seem like a good thing, the bottom line is you need to attend to your monthly credit card bills.

If you only pay the minimum amount specified by the company every month, you will still be charged interest on the balance amount pending. This means that you will begin to accumulate interest every month on your balance amount unless you pay the entire sum.

Another thing that companies neglect to mention is something called as 'revolving interest'. You know that you are paying interest on your balance amount due. However, what you do not realise is that you are also charged interest on the interest amount itself. This means that the interest amount itself keeps accumulating and could wind up being higher than the original amount that you did not pay.

The best way to avoid being trapped in such a situation is to not accept credit cards. If you really need them and there's no other way out, limit yourself at the most to two or three credit cards. Try to pay off your bills every month so that you are not charged interest on any balance amounts due.

Keep Money Available

It is always a good idea to have a reasonable amount of money in your

savings account. This way, you can cover emergency expenses like sickness or injuries that require hospitalisation or extensive treatment. You will also have enough money available for groceries, bills, fees, etc. if you lose your job and cannot find another one immediately. Set aside a predetermined amount of money every month that will constitute your savings. You may have to forgo dinners in fancy restaurants but it will be worth it. Anything beats debts!

Get Yourself Some Insurance

Another common mistake that people make is not to have life and health insurance. While most companies will offer you insurance for the duration that you are an employee, you should remember that this is not permanent. If you leave, or if you are laid off at your workplace, you will lose your insurance. This will leave you financially vulnerable if some illness or mishap befalls you or a member of your

family. Try to imagine what it would be like if your family depended on your income for their daily living and you left them without any

money for them to be able to support themselves.

Plan for the Future

It is never too early for you to start planning for your retirement. By waiting till you are older, you are losing a chance to increase your money through investments. Also, begin saving money for educational expenses, as soon as your child is born. This way, you will be able to invest smaller amounts compared to the money you will have to invest if you wait for your child to reach around ten years of age and then begin.

Keeping your finances in order is not such a difficult task. All you need is a little time, and a few simple decisions, to be able to say goodbye to your financial troubles.